Creator economy statistics for 2026: where the money's moving

A new era of the creator economy is taking shape in 2026. Digital creators are rapidly professionalizing, operating as solo entrepreneurs, diversifying income beyond sponsorships, and adopting AI to manage operations. As burnout and attention scarcity reshape member behavior, community-led business models and owned memberships are emerging as the most sustainable foundation for creator income.

2026 creator economy stats at a glance:

- 48% of creators run everything themselves

- 88% of community builders monetize with memberships

- 67% of members discover communities via social platforms

- 69% say member transformation is their top growth strategy

(Source: 2026 Circle Community Trends Report)

Key creator economy statistics for 2026

How big is the creator economy in 2026? Big, fast-growing, and increasingly shaped by how creators build owned businesses rather than how large their audiences are.

At the macro level, the global creator economy was valued at roughly $200 billion in 2025 and is projected to grow at a 22.7% compound annual growth rate, putting it on track to surpass $800 billion by the early 2030s.

Circle’s data from the Trends Report shows that a growing share of this expansion is happening inside community-led, owned platforms, not solely on social networks. Circle now supports 18,000+ active communities, underscoring a steady migration toward spaces where creators control access, monetization, and member relationships. For many creators, communities are no longer a side project or a nice-to-have extension of branding.

They’re the whole business.

This shift is both recent and accelerating. 56% of creators launched their community in the last couple of years (2024–2025), indicating that community-building has become a near-default move for newer creator businesses rather than a late-stage optimization.

Interestingly, scale is not the defining factor. 44% of communities have between 1 and 100 members, showing that much of this growth is happening at a smaller scale. Many of these communities are intentionally designed to stay small, while prioritizing retention, outcomes, and recurring revenue over rapid audience expansion.

Taken together, the data points to a creator economy increasingly shaped by connection, not attention. Growth is concentrated inside small, intentional communities where belonging, transformation, and recurring value matter more than reach.

How many creators are there in 2026?

Pinning down an exact count of “creators” in 2026 is difficult, largely because the role itself has fractured into multiple operating models. What the data does show, however, is how creators are organizing their work and where economic activity is concentrating.

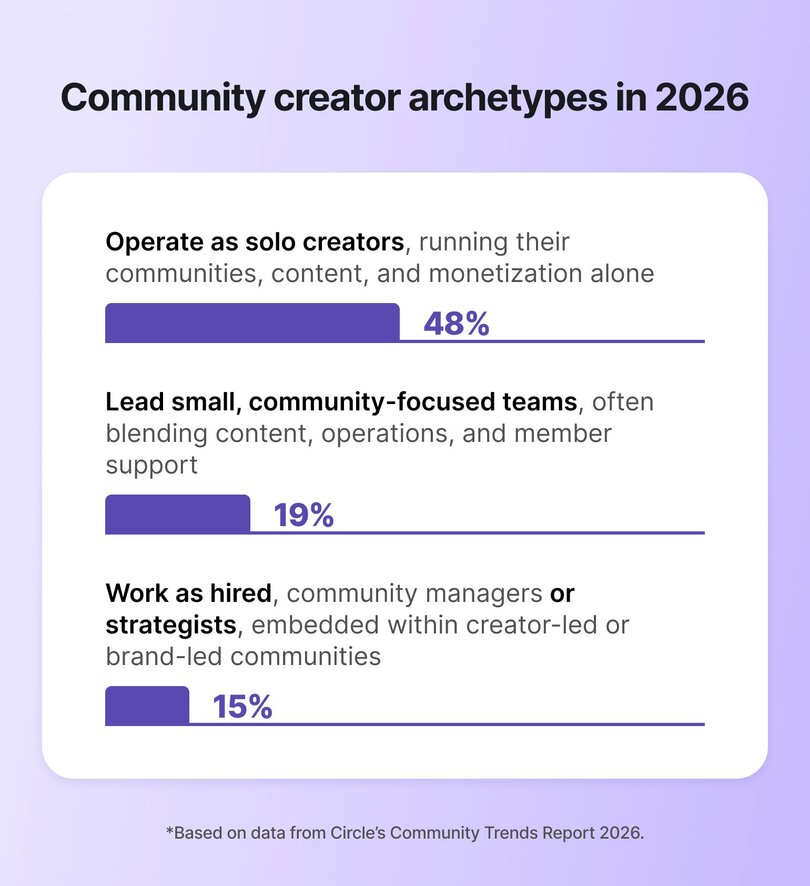

Our survey responses point to three dominant creator archetypes:

- 48% operate as solo creators, running their communities, content, and monetization alone

- 19% lead small, community-focused teams, often blending content, operations, and member support

- 15% work as hired community managers or strategists, embedded within creator-led or brand-led communities

The most interesting finding is that creators are no longer functioning solely as content producers. They’re increasingly responsible for:

- Marketing

- Revenue generation

- Member engagement and experience

- Tooling

- Long-term retention

Community-led business models accelerate this shift by making creators directly accountable for outcomes beyond reach and engagement. As a result, the traditional boundaries between creator, founder, and operator are being blurred.

In other words, solo creators increasingly function as full-stack operators, overseeing monetization, member lifecycle design, and analytics. As communities shift from nice-to-have to core revenue assets, creators are looking to build small teams to support growth. The rise of formal community roles reflects a broader maturation of creator businesses and their growing operational demands.

How do creators make money in 2026?

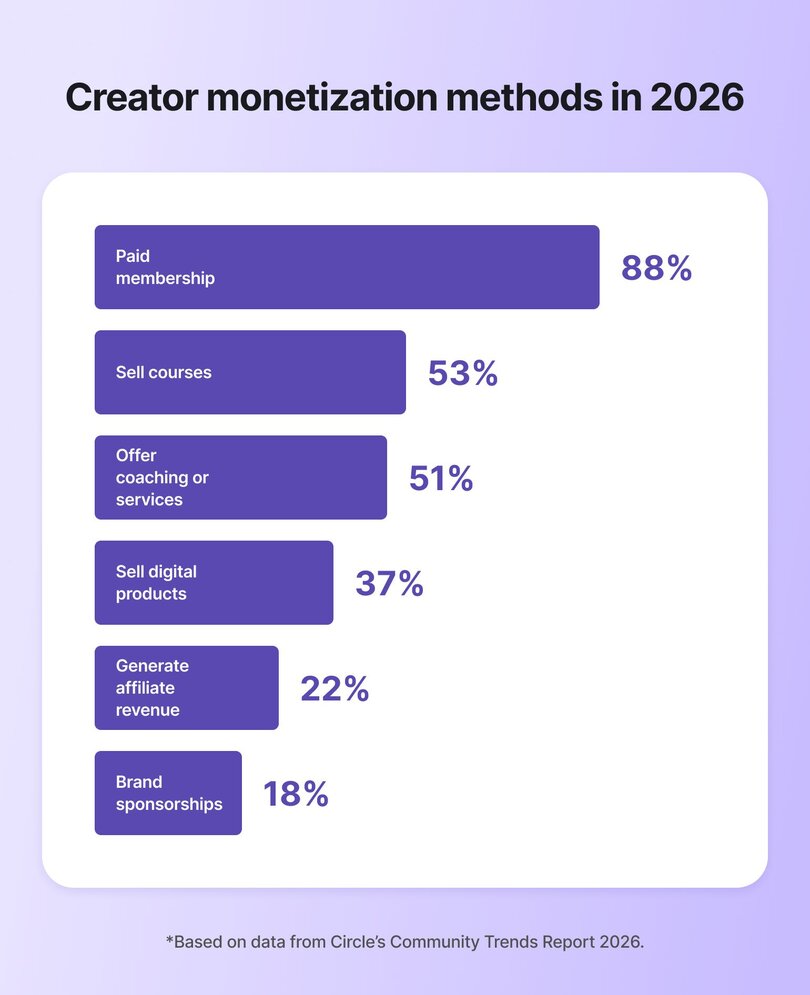

Creator monetization in 2026 is increasingly anchored in owned, recurring revenue, rather than platform-dependent income streams. Our survey data shows a clear pattern in how creators generate income today:

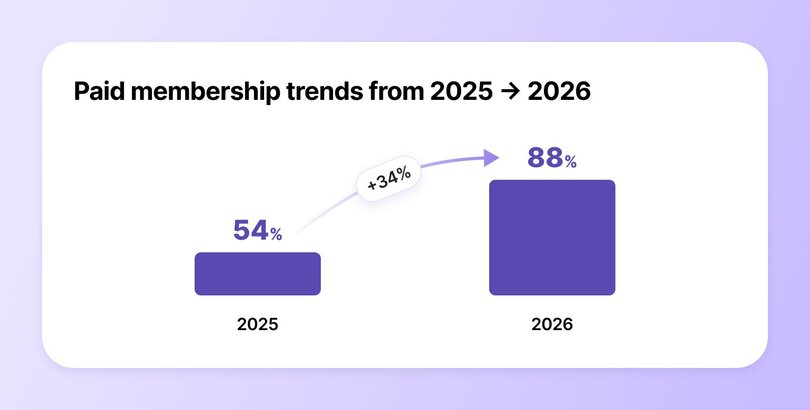

- 88% monetize through paid memberships

- 53% sell courses

- 51% offer coaching or services

- 37% sell digital products

- 22% generate affiliate revenue

- 18% earn from sponsorships

The ordering itself is instructive. Recurring, community-based revenue now sits at the center of creator business models, while sponsorships and affiliate income play increasingly peripheral roles.

Last year’s Circle data reveals that just 54% of creators offered paid memberships and 41% relied on recurring subscriptions, alongside a wider mix of one-off products, services, and brand deals. In 2026, memberships have moved from one monetization option among many to the primary revenue foundation for most community-led creator businesses.

Speaking of pricing, most communities (32.9%) charge between $26–$50 per month, positioning memberships as accessible purchases rather than massive financial commitments. As a result, creators are able to support predictable monthly revenue while leaving room to layer higher-ticket offers, such as courses and coaching.

Overall, the data speaks volumes: there’s a clear shift from transactional monetization to systemized revenue design. Creators are optimizing for stability first, then layering growth through higher-touch offers as trust compounds.

Which creator monetization models are growing fastest?

In 2026, the fastest-growing creator monetization models are those that compress the distance between value creation and value capture. Rather than optimizing for audience expansion, creators are increasingly optimizing for measurable outcomes, repeat engagement, and predictable cash flow.

Survey data shows that 69% of creators now prioritize member transformation as their primary driver of retention and growth. This signals a structural shift: revenue growth is no longer correlated with content frequency or reach, but with a community’s ability to deliver tangible progress. Models that support clear outcomes naturally support higher retention and longer customer lifecycles.

This emphasis on outcomes is reshaping growth strategy. 39% of creators report intentionally de-prioritizing member growth in favor of higher-touch, higher-ticket offerings.

From an economic standpoint, this reflects a move away from scale-dependent models toward margin- and lifetime-value optimization. Fewer members, when paired with deeper engagement, can generate comparable or greater revenue with lower operational volatility.

At the same time, 12% of creators are capping membership size to preserve intimacy and experience quality. This constraint functions as both a retention mechanism and a pricing lever. Smaller communities reduce moderation overhead, increase peer-to-peer value, and justify premium positioning without requiring continuous acquisition.

Rachel Starr, Founder of CoCreator Society, says:

“The people I’m working with are moving away from chasing bigger member numbers. They’re charging more and offering a higher level of service in return. To earn trust today, you have to be more nurturing. It takes a lot more hand-holding than it did a year ago.”

Taken together, these trends indicate that the monetization models growing fastest in 2026 share three characteristics: recurring revenue, outcome alignment, and intentional limits on scale (to focus on quality).

Which platforms generate the most revenue for creators?

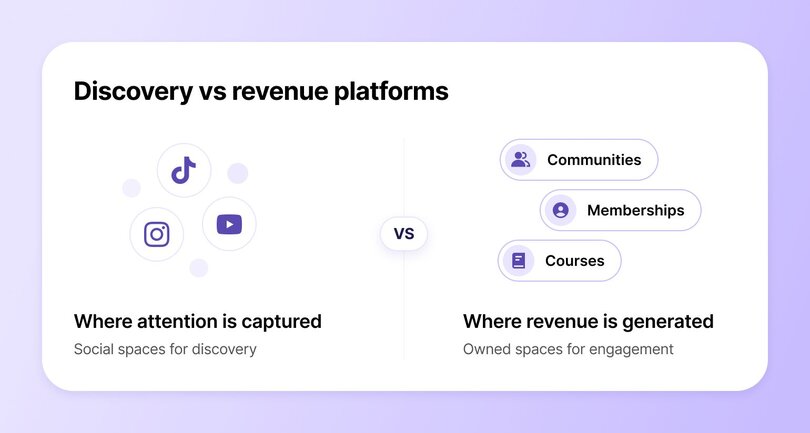

In 2026, creator businesses are increasingly shaped by a split between where attention is captured and where revenue is generated.

Social platforms still dominate discovery. 67% of creators say new members find their communities through social apps, confirming that platforms like TikTok, Instagram, LinkedIn, and YouTube remain critical top-of-funnel channels (down slightly from 76% last year). Visibility still lives on social.

At the same time, revenue is becoming harder to extract from platforms that creators don’t control. 32% of our survey respondents cite unreliable or declining social reach as a major strategic concern, pointing to algorithm volatility, shifting incentives, and limited access to audience data. In practice, creators may reach thousands, but convert only a fraction and often, inconsistently.

As a result, the gap between reach and revenue is pushing monetization downstream. Discovery happens on social media, but revenue is made on owned platforms where creators control access, pricing, and engagement. Instead of optimizing for impressions, creators are optimizing for conversion, retention, and lifetime value.

The rise of “community-led creators” in 2026

Another growing trend is the rise of community-led creators. These creators prioritize long-term relationships and shared progress inside owned communities, shifting away from transactional content models toward sustained, member-first businesses.

The rise is closely tied to changing member behavior. 57% of community builders say evolving member expectations are reshaping their strategy, while 45% report signs of member burnout. Audiences are increasingly disengaging from always-on content environments and seeking spaces that feel focused, intentional, and worth their sustained attention.

In response, 50% of community leaders now use micro-learning and bite-sized formats to reduce overwhelm, replacing constant programming with fewer touchpoints designed to create clearer outcomes.

Notably, communities are also becoming harder to separate from the business itself. 39% of creators report increased collaboration across teams, reflecting how communities now shape education, product feedback, marketing, and customer success.

Looking ahead, the shift is expected to accelerate. 69% of creators say community will become a bigger part of their strategy next year, signaling a long-term move toward owned, community-led business models.

“There was a time where we focused solely on the community and its members, but that’s no longer the case: we’ve become a lot more integrated with teams across the business. Operating outside of our baseline support use case, we’re now integrated with Customer Success and Customer Marketing, Sales & Renewals, and so much more.”

– Nikki Thibodeau, Regional VP of Digital Engagement and Community at Calix

What creators struggle with most

It’s safe to say that the creator economy is maturing, but not without friction. Declining reach, rising expectations, and operational complexity are colliding at once. What emerges from the data isn’t a single pain point, but a pattern of pressures that explain why so many creators are rethinking how their businesses are structured.

Daily operating rhythms are busy, but lonesome

Despite these shifts, the day-to-day reality of running a community remains demanding.

- Almost half of operators run their business entirely solo

- 27% rely on six or more tools to manage their community business

- Many workflows remain manual, increasing cognitive load and time pressure

The old model (social only) pushing them away

Creators aren’t abandoning social platforms by choice. They’re being pushed. Unreliable reach has become a structural risk, and member fatigue is at an all-time high.

Key pressure signals:

- 32% cite declining or unreliable social reach as a major strategic concern

- 45% report visible signs of member burnout

- Digital overwhelm shows up across member activity, as constant content, notifications, and programming drive diminishing engagement

Together, these pressures expose a core weakness in the old model: growth that depends on constant visibility is brittle.

Tighter, more human group dynamics pulling them in

While pressure mounts, creators are being pulled toward models that feel calmer, more human, and more sustainable in the long run.

- 48% community builders now allow people to engage before purchasing, using community participation as a confidence-building layer rather than a hard paywall

- 69% creators prioritize member transformation as their primary growth driver

- 73% view emotional safety as a key differentiator, indicating that psychological trust now plays a measurable role in retention.

Meanwhile, anxieties bubble in the background

Beneath it all sits persistent uncertainty. Top concerns include:

- 28% worry about market saturation

- 27% feel increased pressure to prove ROI

- Tool overload is no longer sustainable, pushing creators to consolidate core functions like community, education, events, and monetization into fewer, more integrated systems

Participation and engagement trends in 2026

When it comes to participation and engagement, there’s one clear trend: async is taking a much more central role than it did last year.

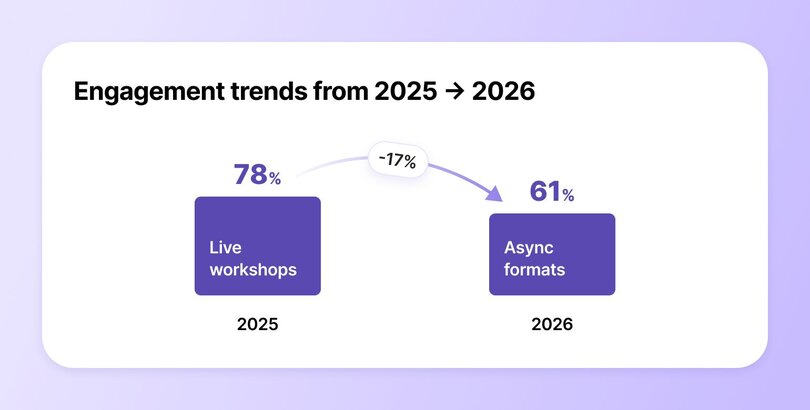

According to last year’s data, engagement strategies were largely built around live events:

- 78% of communities relied on live educational workshops

- 60% hosted small-group discussions

- 47% ran office hours or live Q&A sessions

In short, live programming was positioned as the primary driver of connection and retention. In 2026, that model is being recalibrated.

Creators are still investing in engagement, but they’re doing so with greater restraint and intentionality. This year’s survey data reveals that 61% of creators now use async formats as a core engagement channel. Beyond async participation, community operators are further adapting their strategies to reduce overload:

- 21% are actively reducing programming to prevent burnout

- 21% have introduced intentional quiet periods or rest phases

The key takeaway? Engagement in 2026 is no longer about volume or frequency. Creators are optimizing for depth, designing fewer interactions that respect attention, reduce burnout, and deliver clearer value to members whose attention is also broken up.

AI & automation in the 2026 creator economy

Last year’s data showed AI adoption was already widespread, but largely exploratory. Most creators used AI to support individual tasks rather than to reshape how their businesses operated. Usage clustered around low-risk, high-visibility functions:

- 76% used AI for content creation or editing

- 47% for note-taking and transcription

- 41% for data analysis

At the same time, advanced use cases were still nascent. Only a small fraction of creators were using AI agents, even though 70% said they planned to explore them.

By 2026, that experimentation has settled into more deliberate patterns. Instead of asking what AI can do, creators are deciding where it should quietly sit. 2026 data shows:

- 75% use AI for content creation or planning

- 46% apply AI to generate insights and analyze data

- 34% leverage AI for member support

- 18% deploy AI agents for community moderation

This distribution suggests a widening gap between surface-level adoption and deeper integration. While content-related use remains dominant, growth is strongest in functions tied to scale, support, and efficiency. Importantly, adoption is still accelerating. 68% of creators plan to expand AI usage further in 2026 and beyond.

Future of the creator economy (2026–2027)

The creator economy over the next 12–24 months will be defined less by expansion and more by consolidation, focus, and durability—much like the more mature startup space has been. The data points to fewer bets, clearer systems, and communities run like businesses rather than side gigs.

- Tool consolidation will accelerate. With 45% of creators actively consolidating their tech stacks, the days of sprawling, duct-taped systems are numbered. Creators are prioritizing fewer, more integrated platforms that reduce operational drag and free up time for member-facing work. The winning setups will centralize membership, content, events, payments, and workflows in one place. (Wink, wink!)

- Emotional safety will become a design requirement. Community design is shifting from engagement-first to trust-first. With 73% of creators now treating emotional safety as a conscious design choice, moderation, onboarding, and guidelines will increasingly determine community health and retention. High-growth communities will be engineered for psychological safety, with clear member boundaries and private spaces designed for vulnerability.

- AI will become an operations layer, not a feature. AI adoption will continue to rise, but mostly behind the scenes. Creators will use automation for member support, moderation, analytics, onboarding, and workflow triggers. The goal is not scale for scale’s sake, but reducing time-to-value for members while keeping human touchpoints where they matter most.

- Transformation-first communities will outperform content-first ones. Member transformation will increasingly anchor pricing and retention. Communities will be structured around outcomes like skill progression, accountability cycles, and visible wins, rather than content libraries alone. Progress tracking, cohort-based experiences, and milestone-driven programming will become standard.

- Less programming, higher standards. Reduced calendars and intentional pacing will become strategic choices. Higher-quality touchpoints will replace constant activity, allowing creators to protect energy while improving outcomes.

- Ownership will drive revenue stability. Owned platforms will remain the financial backbone of creator businesses. Memberships, course-plus-community bundles, and recurring access offers provide predictability that social platforms cannot.

- Creators will charge a premium for higher-touch formats. In the near future, pricing power in the creator economy will increasingly come from intimacy rather than scale. Creators will intentionally limit access through capped memberships, cohorts, and smaller groups, allowing them to deliver more direct feedback, accountability, and hands-on support.

The bottom line

The creator economy in 2026 looks very different from the one most headlines still describe. Growth is no longer concentrated in reach, platform virality, or brand deals, but in owned, recurring businesses built around communities. Creators are consolidating tools, tightening operations, and prioritizing member outcomes

Across every data point, the signal is consistent. The most resilient creator businesses are optimizing for depth over scale, systems over hustle, and long-term value over short-term spikes.

Ready to dive deeper? Download our complete 2026 Community Trends Report for detailed insights on how creators actually build revenue, run communities, fight burnout, and diversify off social media.

FAQs about hybrid events

How much do creators earn from memberships or communities?

According to Circle’s 2026 Community Trends Report, creator income from communities spans a wide spectrum, reflecting different levels of business maturity and monetization focus. Annual community revenue breaks down as follows:

- 21% are pre-revenue

- 21% generate under $10,000 per year

- 16% earn $10,000–$50,000 annually

- 15% generate $50,000–$250,000 per year

- 8% earn $250,000–$1M annually

- 4% generate more than $1M per year

- 15% report not monetizing yet

How much do creators earn from advertising and sponsorships in 2026?

As per Circle’s 2026 data, only 18% of creators earn revenue from advertising or sponsorships. This makes sponsorships and brand partnerships one of the least common monetization methods among community-led creators. While sponsorships can still generate meaningful income for a small subset, most creators now treat them as supplemental rather than foundational.

Which companies offer the best tools for creators to increase their earnings?

One of the best tools for creators to increase their earnings is Circle. Circle helps creators turn audiences into owned, recurring revenue by bringing communities, courses, events, payments, email marketing, and automation into a single platform under your own brand.

The biggest advantage of Circle is that you don’t need to stitch together multiple tools. You can manage memberships, sell courses, run events, launch branded mobile apps, and automate engagement all in one place. For busy creators who often operate solo, this reduces operational overhead while keeping every core tool needed to run a community-led business in one system. With Circle, creators own their platform and control pricing, which helps build more predictable income streams that are less dependent on algorithms, sponsorships, or one-off launches.