7 money mindset shifts that’ll set you free as a creator

Most creators don’t fail because they lack talent or good ideas—they fail because they lack a plan for their money.

At Circle’s Creator Path Summit—we sat down with none other than Tori Dunlap, founder of Her First $100K (a financial education membership and accountability community) and host of the #1 money podcast for women.

Tori turned a $40 blog and monthly workshops into a global, multimillion-dollar movement—helping over 5 million women build wealth while “kicking patriarchal ass,” as she puts it. She’s got the tools, books, and paid guides to prove it (plus a bestselling book and movement to back it).

In her keynote, she walked us through how creators can think like CFOs, price with confidence, and build businesses that last—on platforms they control and systems they set.

If you want to shortcut the path to financial clarity, it’s time to dive into the 7 mindset shifts Tori champions as essential for any creator who wants to build a business on their own terms.

The playbook: 7 mindset shifts that made Tori a millionaire creator

1. “Know your ramen and sushi numbers”

One of the most important mindset shifts Tori teaches is deceptively simple: know how much you actually need to live.

Why? Because most creators dream about six-figure launches, but haven’t done the math on what their business needs to earn to simply sustain them as a human, and eventually, let them thrive in their business.

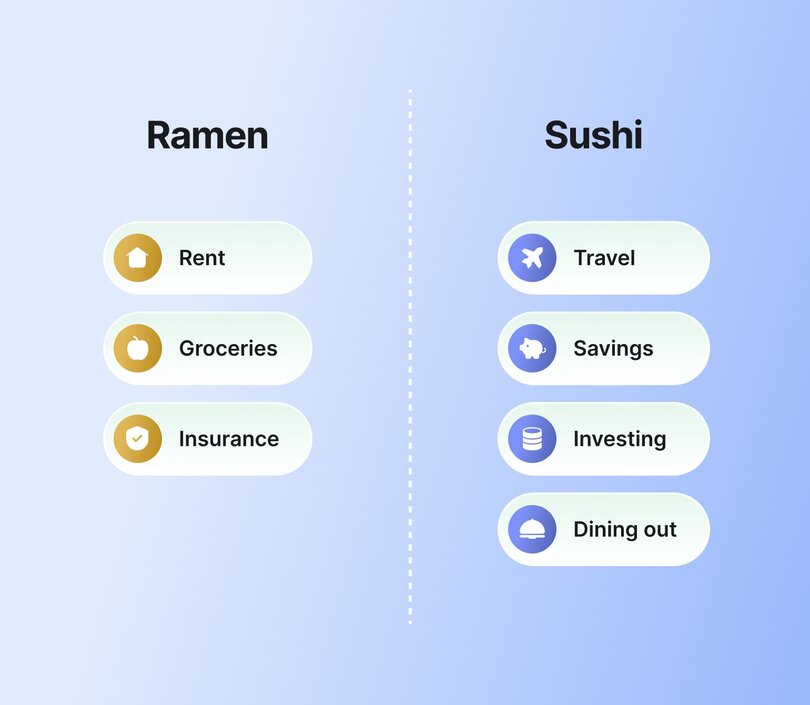

Tori breaks this down into two numbers every creator should know:

- Your “Ramen Number” — the minimum amount your business needs to bring in each month for you to survive. Rent, groceries, insurance. Basic life.

- Your “Sushi Number” — the income goal that lets you live the life you’re dreaming of. A little travel, going out with friends, saving and investing, and most importantly, margin to breathe and enjoy.

“This is your first homework,” Tori says. “You need to know your ramen noodle number beyond any other number. You need to know the bare minimum amount your business needs to be making in order to cover yourself.”

2. “Act like a CFO, even if you’re a creative”

One of the biggest myths among creators? That being right-brained excuses you from understanding your finances.

“I work with a lot of creative entrepreneurs,” Tori said. “They’ll tell me, ‘I do the creativity—I don’t do the number parts.’ I majored in theater. If anyone’s right-brained, it’s me. But I’m a multimillionaire because I chose to treat my business like a business.”

Tori has a strong stance on this: even if you have a CFO, you’re still responsible for knowing your numbers.

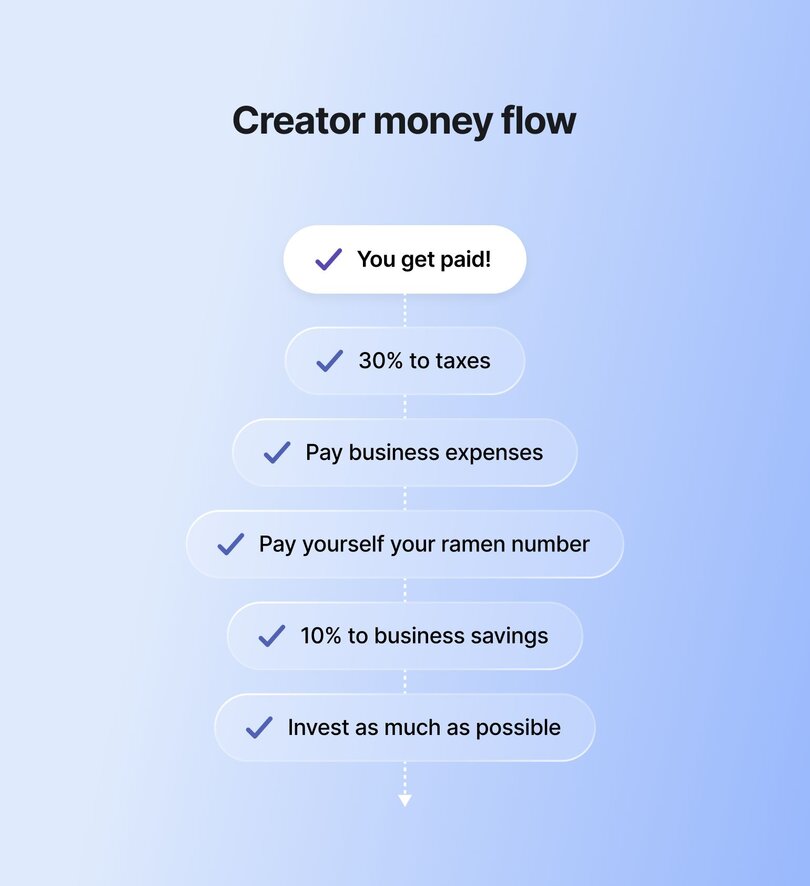

Moreover, at the core of her philosophy is a simple but powerful principle: money should have a job the moment it hits your account. She broke down her go-to system for handling income:

- 30% goes to taxes — Yes, it’s high, but it saves you from getting a scary surprise come tax season.

- Pay your business expenses — Keep them ALAP (As Lean As Possible), especially early on.

- Pay yourself — Start with your ramen number; build toward your sushi number.

- Set aside reserves — Ideally 10%, but even just a couple percentage points if that’s all you can do

- Invest the rest — So you have something to show for your work.

Many creators start making more than they did in their 9–5s—but still end up with no real savings or investments. Tori urges creators to shift their focus from just making money to actually building wealth.

3. “Build on your own land”

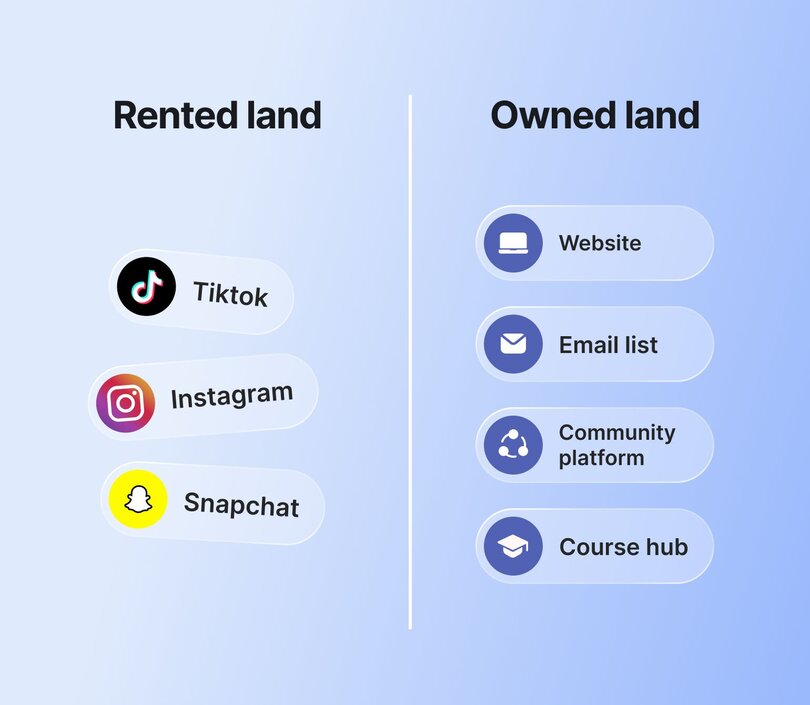

If your income depends entirely on brand deals, affiliate links, or social platforms, you’re building on rented land. Algorithms shift, rules change, and entire revenue streams can vanish overnight—you’re at the mercy of platforms you don’t control.

Tori’s message is clear: use social platforms for discovery, but build your business somewhere you own. “Virality is cool,” she said, “but systems are better.”

In Tori’s own business, a casual TikTok once racked up over 6 million views. But what turned that virality into revenue was the quiz funnel powering it behind the scenes. That single video added 100,000+ email subscribers and, along the way, generated over $4 million in sales. That’s the power of building on your own land: creating systems that capture attention, convert leads, and scale income—long after the post has faded from the feed.

Use platforms like Instagram or TikTok to attract, but bring your audience into owned spaces:

The goal? Shift from external revenue (sponsorships, affiliate links) to internal revenue (products you control). That’s the foundation of a resilient creator business model—one designed to scale on your terms, not someone else’s.

4. “Price like a one-woman agency”

Whether you're pricing an online course or a community, it's an emotional decision—and a hard one to get right. Most creators tend to undercharge, not because their work isn’t valuable, but because they haven't been taught to think like a business.

Tori’s advice? Stop pricing based only on your time or effort.

Instead, think like a full-service agency: “You're not just a content creator. You're a one-person marketing agency. You are handling strategy, you're handling content creation, you're handling posting, you're handling analytics, you're handling the back and forth, and the communication with brands.”

Your pricing should reflect:

- The labor involved in creating content

- The influence you bring to your audience

- The overhead of running a solo business

And if a brand says yes too quickly? You probably priced too low. “If it’s an immediate yes, you didn’t charge enough,” Tori says. You need to push until you find the edges.

5. “Money is a tool, not the enemy”

The relationship with money can be complex, especially for women and marginalized folks. Shame, fear, or learned avoidance can quietly sabotage even the most talented creators. That’s why Tori insists:

“Money allows you the ability to exercise your self-worth.”

—Tori Dunlap

Money isn’t something to fear or feel guilty about. It’s a tool. A lever. A way to design a life and business that actually aligns with your values.

Tori encourages every creator to build an “F‑Off Fund”—enough savings to walk away from any situation that threatens your safety or well-being. “You need enough money to be able to get yourself out of an unsafe situation,” she said. “Maybe that’s a toxic job. Maybe that’s an unsafe relationship. I need you to have enough money to leave.”

Without it, you’re stuck making survival decisions 😰.

With it, you can choose your clients, pace, and platforms from a place of clarity, not panic.

This mindset shift helps creators stop asking their business to solve their personal finances. Instead, they get strategic, so their business fuels their freedom, not their fear.

6. “Gamify the business, not your sanity”

When things get hard, most creators blame themselves. A quiet launch, a slow month, a drop in engagement—suddenly it feels like you’re failing. But Tori offers a different way to look at it: “Think of your business like it’s a game. Take the serious stuff seriously, and make the rest playful.”

Instead of spiraling over setbacks, start asking better questions.

- What’s one lever you can pull?

- What’s a variable you can test?

- What can you bring back from your archives?

Tori shared how her team was $20K away from their revenue goal a few months ago. Instead of stressing, they launched a last-minute flash sale and hit their goal in 45 minutes.

This is what happens when you zoom out and treat your business like a system you’re learning to master, not a test you’re constantly failing. Try things. Tweak things. Keep what works.

Gamifying your business just means staying curious and creative, even when things get tough. It helps you bounce back faster, learn what works, and keep going without burning out.

7. “Automate everything you can”

Lastly, Tori brings it full circle with one of her most powerful lessons: automate everything you can—not just your funnels and community engagement, but your finances too.

“This right here is the best financial tip I can give,” says Tori. “Automate your money.”

For creators, that means setting up automatic transfers from your income into high-yield savings accounts, tax buckets, and business reserves. Whether it’s every time you get paid or once a month, this simple habit builds consistency—and protection—over time. “Maybe it’s 10% of what your business brings in,” she adds. “But this is what’s called paying yourself first.”

The real power of automation? It frees up your energy to be creative, strategic, and human while your systems quietly help you build your future behind the scenes.

Creator wealth is a strategy, not a dream

The biggest shift you can make today as a digital business owner? Start seeing wealth not as a dream, but as a strategy you actively work on.

That means:

- Knowing your numbers like a CFO

- Building on platforms you own and control

- Using money to claim your power, not just survive

Wealth isn’t selfish—it’s strategic. It gives you choices, control, and long-term freedom.

For women, queer creators, and creators of color, building wealth isn’t just smart—it’s a radical act of self-determination. This is what creator financial freedom really looks like: choice, control, and long-term independence.

👉 If you’re a creator who wants to earn more on your own terms—with your people? Use the community ROI calculator to see how much you could earn by launching a paid community.

FAQs

What is the money mindset shift in psychology?

The money mindset shift in psychology comes from a blend of behavioral economics, cognitive psychology, and financial therapy. It’s rooted in the idea that our financial behaviors are deeply shaped by subconscious beliefs (often formed in childhood) about money, worth, and identity.

For example, if you grew up hearing "money doesn’t grow on trees" or saw your caregivers constantly stressed about bills, you may unconsciously associate money with fear or scarcity. Shifting your money mindset involves identifying those inherited beliefs, challenging them, and intentionally rewriting your inner narrative so you can make empowered, rather than reactive, financial decisions.

How does a creator make money?

Creators earn money through several income streams: brand partnerships, affiliate links, digital product sales, online courses, memberships, or coaching programs. That said, the most successful creators don’t rely on just one stream—they tend to diversify their income streams to build a sustainable business model.

Where can I learn more about how to manage money as a creator?

Here's Tori's recommended reading list that helped her think about financial feminism and apply it to her creator journey:

- Smart Women Finish Rich by David Bach

- The Psychology of Money by Morgan Housel

- We Should All Be Millionaires by Rachel Rodgers

- The Financial Diet by Chelsea Fagan & Lauren Ver Hage

- Atomic Habits by James Clear

- Deep Work by Cal Newport

Finally, Tori wrote her own book: Financial Feminist.

What is the best platform to make money as a creator?

There’s no single “best” platform to make money as a creator—it really depends on your audience, your content, and your business model. Some creators thrive on YouTube with ad revenue, others build income through Substack, Patreon, or TikTok brand deals.

However, if you're looking to build a community, offer courses, or host live events, Circle is worth a serious look. Unlike other platforms, Circle gives you full control over your member experience with features like customizable spaces, built-in payments, branded mobile apps, email marketing, and even AI-powered workflows. It's everything you need to turn your audience into a business without giving up control over your earnings.